© 2010 HCREA All rights reserved

295 Madison Avenue, Suite 1714, New York, NY 10017 | (212) 684-2044 | info@hcreadvisors.com

We take care of your real estate needs

Strategy

Look before you lease – seven safety tips

Why landlords treat renewal tenants as a captive market

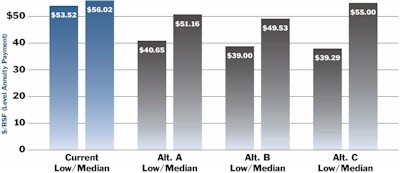

Above: total lease term costs per square foot at alternative locations which

are significantly less expensive than the tenant's current location where the

tenant had assumed the best deal would be.

-- Use time to your advantage. You need to start early enough so you have time for all the normal phases of site selection, financial negotiation and analysis, lease negotiation -- plus time to walk away from a bad deal and continue negotiations elsewhere if need be. This means if you plan to renew at your current location, for a lease in the 50,000 sq. ft. range, you should be actively assessing your options at least 18 months before your target move-in/renewal date.

You could be in for a shock if you let time slip through your fingers. A medical practice explored with its landlord terms for a fairly short-term lease renewal. The landlord agreed to concessions worth about $500,000. Negotiations concluded, but the tenant neither acted nor developed other options. Months later -- about 12 months before lease expiration -- they responded to their landlord and said they were ready to proceed. The landlord assessed his options -- particularly noting that the tenant had not developed alternatives -- and replied: "I'd like to proceed, but times have changed. The $500,000 we talked about isn't on the table anymore."

-- Understand your options in the marketplace. If you don't have a good idea what lease terms other tenants in the marketplace are getting now, then you have no way of determining whether a landlord's proposed renewal is a good deal or a bad deal. Your landlord’s offer could easily be inferior to what tenants around your area and across the country are getting, in which case it would qualify as a bad deal even though it might be an improvement over your original lease.

Rent and workletter allowance are just the beginning. Every bit as important are terms buried in the fine print, terms which can undermine what you assumed to be a good deal. For instance, the operating expense clause, electricity clause, use clause, sublease clause and all clauses relating to landlord performance standards.

-- Use your inside knowledge of your current facility and/or landlord's operations to formulate the terms of your renewal deal. As a long-time resident of the building where you plan to renew, you have a key advantage that can help you secure improved lease terms. You know the physical characteristics of the building and how it has functioned in the past. If you have always been dissatisfied with the way the common area lavatories look, elevator waiting times, how the HVAC system functions, etc., your advisor should be specific about these issues in negotiating your lease renewal. Seek specific quantifiable improvements. Calculate a reasonable dollar value for each improvement to be made and stipulate a penalty or consequence if changes agreed upon are not made within an agreed-upon time period. Implement the changes agreed upon with effective business terms in your new lease.

-- Analyze your current lease in terms of business and operational terms that have been inadequate, too costly, not operated as you expected and intended they might. If, during your years in this building, you have had a real estate advisor who regularly performed detailed annual escalation audits, you have additional inside information that can be extremely valuable to you in structuring a lease renewal. Done properly, these annual audits show you how efficiently your landlord runs the building, what the mark-ups are for certain kinds of important as well as incidental services you may require. Moreover, these audits will show you whether your landlord bills twice for the same services, whether you are paying for services supplied to other tenants, whether your landlord uses insurance reimbursements as a cost center, and how your costs compare to the market. Use this information in improving critical business and operational terms during an extended lease term. The data generated by these audits gives you a second chance to secure the lease terms you really wanted the first time around.

-- Let your landlord know you are actively seeking alternative solutions for your space needs. Preserving good relations with a current landlord is often cited by tenants as a reason for "going it alone" when it comes to handling a lease renewal. The unfortunate effect of such a strategy is that it reinforces ownership's belief that you have no options and don't take the prospect of lease negotiations seriously. It's a clear sign that you are prepared to settle for whatever is offered.

Handling a lease renewal should be treated like any other business operation -- the management team makes a reasoned assessment of all relevant options and selects the best fit. It's important to let ownership know that this is your approach to whatever terms they might offer -- or expect you to accept in a lease renewal.

When a landlord understands that you are objectively evaluating the marketplace, they are likely to become more realistic about what you renewing your lease is worth. By making sure ownership knows you are serious about your options, you are more likely to secure concessions very similar to those being offered to new tenants, and a more favorable rent structure.

-- Understand what it will cost your landlord if you move out. A common stumbling block in renewal negotiations is the undeniable fact that no matter how a good a deal you will get by moving, you will also incur costs that may be substantial -- the cost of the physical move, new telecommunications wiring, perhaps costs of building out new space that go beyond what ownership will supply, new stationery, perhaps new furniture, etc.

Yet the landlord, too, will incur substantial costs if you leave for more favorable terms elsewhere. For instance, potentially lost revenue, promotional costs, brokerage commissions, infrastructure refurbishment, demolition costs and build-out costs. In every situation, these costs can be quantified with a high degree of accuracy, and should be part of discussions with landlord to maximize the value you get as a renewing tenant.

The differential in these costs -- what a landlord will spend to attract a new tenant, and what they will spend to retain you -- can be substantial, and easily exceed a year's rent. With an astute strategy and a properly structured negotiation -- some portion at least, of these savings, can be used to further reduce your costs should you elect to renew at a current location.

--Be prepared to move if you can't get market-rate terms. Ultimately, if your analysis of the market, taking into account all relevant factors shows that a substantially lower present value occupancy cost will result from moving, this is probably the option you should select. Moving for marginal savings – 2% or 3% -- might not be warranted, but if projected savings are 5% or more, this is likely to be your better option. No matter how specialized your facility, no matter how convenient its location, no matter what the cost of build-out, if a comprehensive site selection process, financial and lease analysis shows you can get better terms elsewhere, it may be time to move on. Occupancy costs are often the second largest fixed cost a tenant faces; in total they may consume up to 50% of net revenue. Managing occupancy costs is a critical corporate responsibility. When landlords understand that lease renewals are not a "sure thing"; when tenants regularly subject lease renewals to an objective, market-driven process, the result is likely to be reduce occupancy costs across the board.